Page 297 - Microsoft Word - FY 2020 Adopted Budget Document

P. 297

Appendices

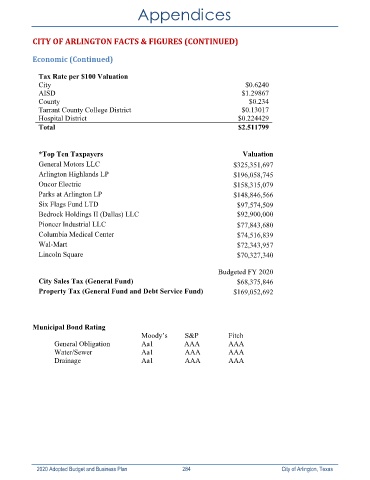

CITY OF ARLINGTON FACTS & FIGURES (CONTINUED)

Economic (Continued)

Tax Rate per $100 Valuation

City $0.6240

AISD $1.29867

County $0.234

Tarrant County College District $0.13017

Hospital District $0.224429

Total $2.511799

*Top Ten Taxpayers Valuation

General Motors LLC $325,351,697

Arlington Highlands LP $196,058,745

Oncor Electric $158,315,079

Parks at Arlington LP $148,846,566

Six Flags Fund LTD $97,574,509

Bedrock Holdings II (Dallas) LLC $92,900,000

Pioneer Industrial LLC $77,843,680

Columbia Medical Center $74,516,839

Wal-Mart $72,343,957

Lincoln Square $70,327,340

Budgeted FY 2020

City Sales Tax (General Fund) $68,375,846

Property Tax (General Fund and Debt Service Fund) $169,052,692

Municipal Bond Rating

M oody’s S&P Fitch

General Obligation Aa1 AAA AAA

Water/Sewer Aa1 AAA AAA

Drainage Aa1 AAA AAA

2020 Adopted Budget and Business Plan 284 City of Arlington, Texas