Page 54 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 54

Section 1 Executive

Community Profile

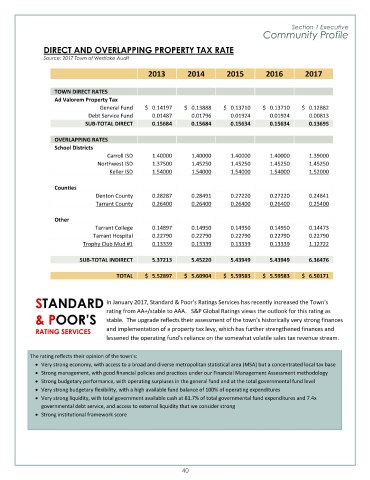

DIRECT AND OVERLAPPING PROPERTY TAX RATE

Source: 2017 Town of Westlake Audit

2013 2014 2015 2016 2017

TOWN DIRECT RATES

Ad Valorem Property Tax

General Fund $ 0.14197 $ 0.13888 $ 0.13710 $ 0.13710 $ 0.12882

Debt Service Fund 0.01487 0.01796 0.01924 0.01924 0.00813

SUB- TOTAL DIRECT 0.15684 0.15684 0.15634 0.15634 0.13695

OVERLAPPING RATES

School Districts

Carroll ISD 1.40000 1.40000 1.40000 1.40000 1.39000

Northwest ISD 1.37500 1.45250 1.45250 1.45250 1.45250

Keller ISD 1.54000 1.54000 1.54000 1.54000 1.52000

Counties

Denton County 0.28287 0.28491 0.27220 0.27220 0.24841

Tarrant County 0.26400 0.26400 0.26400 0.26400 0.25400

Other

Tarrant College 0.14897 0.14950 0.14950 0.14950 0.14473

Tarrant Hospital 0.22790 0.22790 0.22790 0.22790 0.22790

Trophy Club Mud #1 0.13339 0.13339 0.13339 0.13339 1.12722

SUB-TOTAL INDIRECT 5.37213 5.45220 5.43949 5.43949 6.36476

TOTAL $ 5.52897 $ 5.60904 $ 5.59583 $ 5.59583 $ 6.50171

STANDARD In January 2017, Standard & Poor's Ratings Services has recently increased the Town's

rating from AA+/stable to AAA. S& P Global Ratings views the outlook for this rating as

POOR’ S stable. The upgrade reflects their assessment of the town's historically very strong finances

RATING SERVICES and implementation of a property tax levy, which has further strengthened finances and

lessened the operating fund's reliance on the somewhat volatile sales tax revenue stream.

The rating reflects their opinion of the town' s:

Very strong economy, with access to a broad and diverse metropolitan statistical area (MSA) but a concentrated local tax base

Strong management, with good financial policies and practices under our Financial Management Assessment methodology

Strong budgetary performance, with operating surpluses in the general fund and at the total governmental fund level

Very strong budgetary flexibility, with a high available fund balance of 100% of operating expenditures

Very strong liquidity, with total government available cash at 81.7% of total governmental fund expenditures and 7.4x

governmental debt service, and access to external liquidity that we consider strong

Strong institutional framework score

40