Page 135 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 135

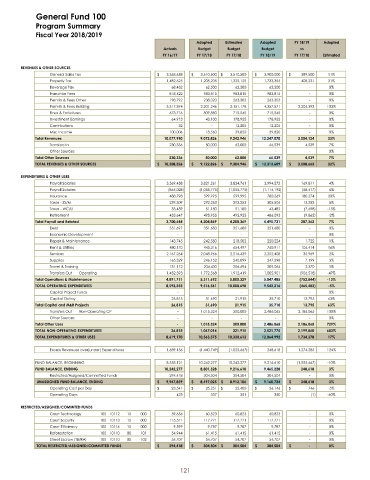

General Fund 100

Program Summary

Fiscal Year 2018/2019

Adopted Estimated Adopted FY 18/ 19 Adopted

Actuals Budget Budget Budget vs

FY 16/ 17 FY 17/ 18 FY 17/ 18 FY 18/ 19 FY 17/ 18 Estimated

REVENUES & OTHER SOURCES

General Sales Tax 3,353,658$ 3,510,500$ 3,510,500$ 3,900,000$ 389,500$ 11%

Property Tax 1,482,625 1,205,205 1,325,125 1,733,356 408,231 31%

Beverage Tax 68,432 62,500 62,500 62,500 - 0%

Franchise Fees 818,422 983,815 983,815 983,815 - 0%

Permits & Fees Other 198,792 238,020 263,303 263,303 - 0%

Permits & Fees Building 3,317,394 2,201,246 2,151,178 4,357,571 2,206,393 103%

Fines & Forfeitures 673,716 809,880 715,545 715,545 - 0%

Investment Earnings 64,913 43,100 178,955 178,955 - 0%

Contributions 32 - 12,205 12,205 - 0%

Misc Income 100,006 18,560 39,820 39,820 - 0%

Total Revenues 10,077,990 9,072,826 9,242,946 12,247,070 3,004,124 33%

Transfers In 230,336 50,000 62,000 66,539 4,539 7%

Other Sources - - - - - 0%

Total Other Sources 230,336 50,000 62,000 66,539 4,539 7%

TOTAL REVENUES & OTHER SOURCES 10,308,326$ 9,122,826$ 9,304,946$ 12,313,609$ 3,008,663$ 32%

EXPENDITURES & OTHER USES

Payroll Salaries 3,369,458 3,821,261 3,824,761 3,994,572 169,811 4%

Payroll Salaries ( 864,028) ( 1,055,775) ( 1,055,775) ( 1,114,192) ( 58,417) 6%

Insurance 488,798 599,995 599,995 780,269 180,274 30%

Taxes - SS/ M 239,309 292,253 292,253 305,506 13,253 5%

Taxes - WC/ U 33,459 51,180 51,180 43,482 ( 7,698) -15%

Retirement 433,647 495,955 495,955 486,093 ( 9,862) -2%

Total Payroll and Related 3,700,644 4,204,869 4,208,369 4,495,731 287,362 7%

Debt 351,697 351,680 351,680 351,680 - 0%

Economic Development - - - - - 0%

Repair & Maintenance 143,745 242,580 218,502 220,224 1,722 1%

Rent & Utilities 480,170 445,316 654,497 760,911 106,414 16%

Services 2,167,264 2,048,966 2,216,439 2,252,408 35,969 2%

Supplies 165,329 246,152 240,099 247,298 7,199 3%

Travel & Training 131,112 204,430 206,694 209,064 2,370 1%

Transfers Out Operating 1,452,393 1,772,568 1,912,419 1,005,901 ( 906,518) -47%

Total Operations & Maintenance 4,891,711 5,311,692 5,800,329 5,047,485 ( 752,844) - 13%

TOTAL OPERATING EXPENDITURES 8,592,355 9,516,561 10,008,698 9,543,216 ( 465,482) - 5%

Capital Project Funds - - - - - 0%

Capital Outlay 26,815 31,690 21,915 35,710 13,795 63%

Total Capital and M&R Projects 26,815 31,690 21,915 35,710 13,795 63%

Transfers Out Non-Operating CP - 1,015,324 300,000 2,486,065 2,186,065 100%

Other Sources - - - - - 0%

Total Other Uses - 1,015,324 300,000 2,486,065 2,186,065 729%

TOTAL NON-OPERATING EXPENDITURES 26,815 1,047,014 321,915 2,521,775 2,199,860 683%

TOTAL EXPENDITURES & OTHER USES 8,619,170 10,563,575 10,330,613 12,064,992 1,734,378 17%

Excess Revenues over(under) Expenditures 1,689,156 ( 1,440,749) ( 1,025,667) 248,618 1,274,285 124%

FUND BALANCE, BEGINNING 8,553,121 10,242,277 10,242,277 9,216,610 ( 1,025,667) - 10%

FUND BALANCE, ENDING 10,242,277 8,801,528 9,216,610 9,465,228 248,618 3%

Restricted/ Assigned/ Committed Funds 294,418 304,504 304,504 304,504 - 0%

UNASSIGNED FUND BALANCE, ENDING 9,947,859$ 8,497,025$ 8,912,106$ 9,160,724$ 248,618$ 3%

5%

Operating Cost per Day 23,541$ 25,251$ 25,400$ 26,146$ 746$ -

60%

Operating Days 423 337 351 350 ( 1) -

RESTRICTED/ ASSIGNED/ COMMITED FUNDS

Court Technology 100 10112 15 000 59,656 60,823 60,823 60,823 - 0%

Court Security 100 10113 15 000 115,511 117,771 117,771 117,771 - 0%

Court Efficiency 100 10116 15 000 9,599 9,787 9,787 9,787 - 0%

Reforestation 100 10110 00 101 54,944 61,415 61,415 61,415 - 0%

Street Escrow ( TB/ RA) 100 10110 00 102 54,707 54,707 54,707 54,707 - 0%

TOTAL RESTRICTED/ ASSIGNED/ COMMITTED FUNDS 294,418$ 304,504$ 304,504$ 304,504$ -$ 0%

121