Page 85 - FY 19 Budget Forecast 91218.xlsx

P. 85

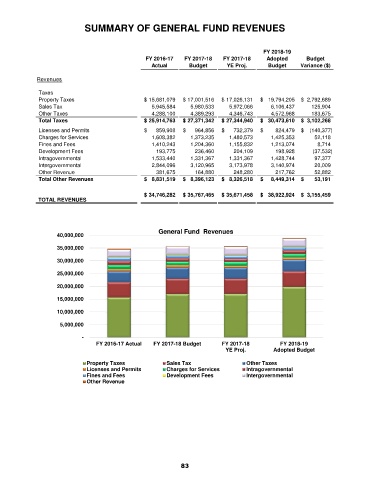

SUMMARY OF GENERAL FUND REVENUES

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

Actual Budget YE Proj. Budget Variance ($)

Revenues

Taxes

Property Taxes $ 15,681,079 $ 17,001,516 $ 17,026,131 $ 19,794,205 $ 2,792,689

Sales Tax 5,945,584 5,980,533 5,972,066 6,106,437 125,904

Other Taxes 4,288,100 4,389,293 4,346,743 4,572,968 183,675

Total Taxes $ 25,914,763 $ 27,371,342 $ 27,344,940 $ 30,473,610 $ 3,102,268

Licenses and Permits $ 859,908 $ 964,856 $ 732,379 $ 824,479 $ (140,377)

Charges for Services 1,608,382 1,373,235 1,480,573 1,425,353 52,118

Fines and Fees 1,410,243 1,204,360 1,155,832 1,213,074 8,714

Development Fees 193,775 236,460 204,109 198,928 (37,532)

Intragovernmental 1,533,440 1,331,367 1,331,367 1,428,744 97,377

Intergovernmental 2,844,096 3,120,965 3,173,978 3,140,974 20,009

Other Revenue 381,675 164,880 248,280 217,762 52,882

Total Other Revenues $ 8,831,519 $ 8,396,123 $ 8,326,518 $ 8,449,314 $ 53,191

$ 34,746,282 $ 35,767,465 $ 35,671,458 $ 38,922,924 $ 3,155,459

TOTAL REVENUES

General Fund Revenues

40,000,000

35,000,000

30,000,000

25,000,000

20,000,000

15,000,000

10,000,000

5,000,000

-

FY 2016-17 Actual FY 2017-18 Budget FY 2017-18 FY 2018-19

YE Proj. Adopted Budget

Property Taxes Sales Tax Other Taxes

Licenses and Permits Charges for Services Intragovernmental

Fines and Fees Development Fees Intergovernmental

Other Revenue

83