Page 17 - FY 19 Budget Forecast 91218.xlsx

P. 17

September 19, 2018

To the Honorable Mayor McGrail and Members of the City Council

Re: The Annual Budget for Fiscal Year 2018‐19

It is my privilege to present to you the FY 2018‐19 Adopted Budget for your review and consideration.

This budget represents months of hard work from your budget team and department directors, and

continues our tradition of conservative fiscal management paired with a commitment to our core values

of excellence, integrity, service, creativity and communication. As always, we remain focused on exploring

new opportunities to provide high levels of service to our citizens in a manner that is both innovative and

resourceful.

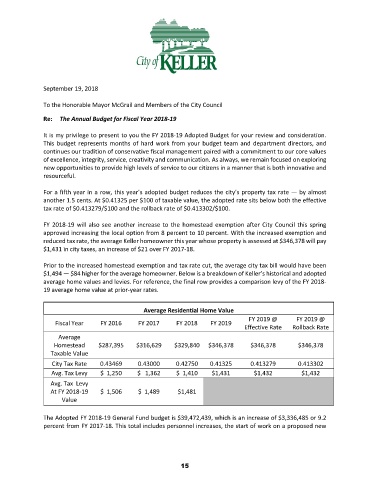

For a fifth year in a row, this year’s adopted budget reduces the city’s property tax rate — by almost

another 1.5 cents. At $0.41325 per $100 of taxable value, the adopted rate sits below both the effective

tax rate of $0.413279/$100 and the rollback rate of $0.413302/$100.

FY 2018‐19 will also see another increase to the homestead exemption after City Council this spring

approved increasing the local option from 8 percent to 10 percent. With the increased exemption and

reduced tax rate, the average Keller homeowner this year whose property is assessed at $346,378 will pay

$1,431 in city taxes, an increase of $21 over FY 2017‐18.

Prior to the increased homestead exemption and tax rate cut, the average city tax bill would have been

$1,494 — $84 higher for the average homeowner. Below is a breakdown of Keller’s historical and adopted

average home values and levies. For reference, the final row provides a comparison levy of the FY 2018‐

19 average home value at prior‐year rates.

Average Residential Home Value

FY 2019 @ FY 2019 @

Fiscal Year FY 2016 FY 2017 FY 2018 FY 2019

Effective Rate Rollback Rate

Average

Homestead $287,395 $316,629 $329,840 $346,378 $346,378 $346,378

Taxable Value

City Tax Rate 0.43469 0.43000 0.42750 0.41325 0.413279 0.413302

Avg. Tax Levy $ 1,250 $ 1,362 $ 1,410 $1,431 $1,432 $1,432

Avg. Tax Levy

At FY 2018‐19 $ 1,506 $ 1,489 $1,481

Value

The Adopted FY 2018‐19 General Fund budget is $39,472,439, which is an increase of $3,336,485 or 9.2

percent from FY 2017‐18. This total includes personnel increases, the start of work on a proposed new

15