Page 49 - Hurst FY19 Approved Budget

P. 49

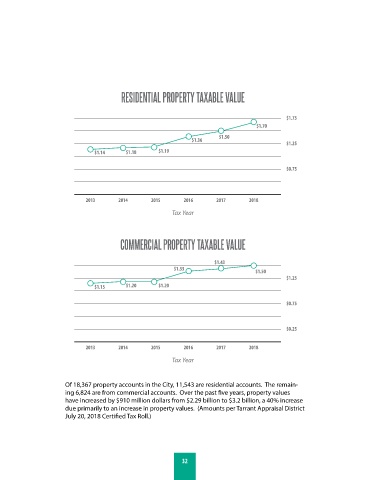

RESIDENTIAL PROPERTY TAXABLE VALUE

$1.75

$1.70

$1.50

$1.36

$1.25

$1.14 $1.18 $1.19

$0.75

2013 2014 2015 2016 2017 2018

Tax Year

COMMERCIAL PROPERTY TAXABLE VALUE

$1.43

$1.33

$1.50

$1.25

$1.15 $1.20 $1.20

$0.75

$0.25

2013 2014 2015 2016 2017 2018

Tax Year

Of 18,367 property accounts in the City, 11,543 are residential accounts. The remain-

ing 6,824 are from commercial accounts. Over the past five years, property values

have increased by $910 million dollars from $2.29 billion to $3.2 billion, a 40% increase

due primarily to an increase in property values. (Amounts per Tarrant Appraisal District

July 20, 2018 Certified Tax Roll.)

32