Page 325 - Hurst FY19 Approved Budget

P. 325

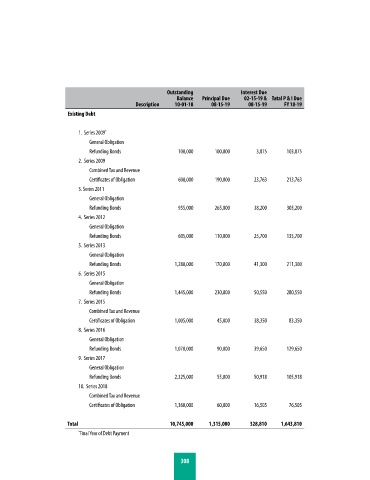

Outstanding Interest Due

Balance Principal Due 02-15-19 & Tatal P & I Due

Description 10-01-18 08-15-19 08-15-19 FY 18-19

Existing Debt

1. Series 2009 *

General Obligation

Refunding Bonds 100,000 100,000 3,875 103,875

2. Series 2009

Combined Tax and Revenue

Certificates of Obligation 600,000 190,000 23,763 213,763

3. Series 2011

General Obligation

Refunding Bonds 955,000 265,000 38,200 303,200

4. Series 2012

General Obligation

Refunding Bonds 605,000 110,000 25,700 135,700

5. Series 2013

General Obligation

Refunding Bonds 1,280,000 170,000 41,300 211,300

6. Series 2015

General Obligation

Refunding Bonds 1,445,000 230,000 50,550 280,550

7. Series 2015

Combined Tax and Revenue

Certificates of Obligation 1,005,000 45,000 38,350 83,350

8. Series 2016

General Obligation

Refunding Bonds 1,070,000 90,000 39,650 129,650

9. Series 2017

General Obligation

Refunding Bonds 2,325,000 55,000 50,918 105,918

10. Series 2018

Combined Tax and Revenue

Certificates of Obligation 1,360,000 60,000 16,505 76,505

Total 10,745,000 1,315,000 328,810 1,643,810

* Final Year of Debt Payment

308