Page 3 - Haltom City FY19 Annual Budget

P. 3

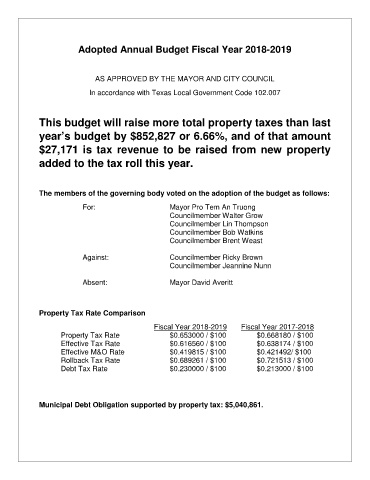

Adopted Annual Budget Fiscal Year 2018-2019

AS APPROVED BY THE MAYOR AND CITY COUNCIL

In accordance with Texas Local Government Code 102.007

This budget will raise more total property taxes than last

year’s budget by $852,827 or 6.66%, and of that amount

$27,171 is tax revenue to be raised from new property

added to the tax roll this year.

The members of the governing body voted on the adoption of the budget as follows:

For: Mayor Pro Tem An Truong

Councilmember Walter Grow

Councilmember Lin Thompson

Councilmember Bob Watkins

Councilmember Brent Weast

Against: Councilmember Ricky Brown

Councilmember Jeannine Nunn

Absent: Mayor David Averitt

Property Tax Rate Comparison

Fiscal Year 2018-2019 Fiscal Year 2017-2018

Property Tax Rate $0.653000 / $100 $0.668180 / $100

Effective Tax Rate $0.616560 / $100 $0.638174 / $100

Effective M&O Rate $0.419815 / $100 $0.421492/ $100

Rollback Tax Rate $0.689261 / $100 $0.721513 / $100

Debt Tax Rate $0.230000 / $100 $0.213000 / $100

Municipal Debt Obligation supported by property tax: $5,040,861.