Page 34 - Grapevine FY19 Operating Budget

P. 34

Fund Balances

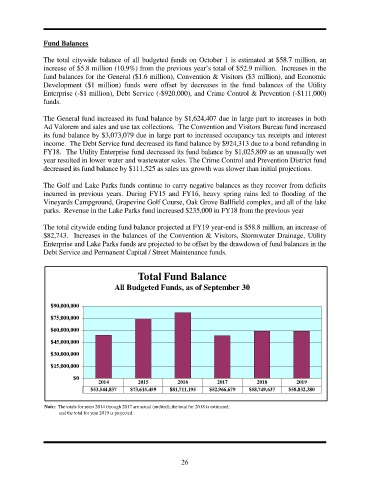

The total citywide balance of all budgeted funds on October 1 is estimated at $58.7 million, an

increase of $5.8 million (10.9%) from the previous year’s total of $52.9 million. Increases in the

fund balances for the General ($1.6 million), Convention & Visitors ($3 million), and Economic

Development ($1 million) funds were offset by decreases in the fund balances of the Utility

Enterprise (-$1 million), Debt Service (-$920,000), and Crime Control & Prevention (-$111,000)

funds.

The General fund increased its fund balance by $1,624,407 due in large part to increases in both

Ad Valorem and sales and use tax collections. The Convention and Visitors Bureau fund increased

its fund balance by $3,073,079 due in large part to increased occupancy tax receipts and interest

income. The Debt Service fund decreased its fund balance by $924,313 due to a bond refunding in

FY18. The Utility Enterprise fund decreased its fund balance by $1,025,809 as an unusually wet

year resulted in lower water and wastewater sales. The Crime Control and Prevention District fund

decreased its fund balance by $111,525 as sales tax growth was slower than initial projections.

The Golf and Lake Parks funds continue to carry negative balances as they recover from deficits

incurred in previous years. During FY15 and FY16, heavy spring rains led to flooding of the

Vineyards Campground, Grapevine Golf Course, Oak Grove Ballfield complex, and all of the lake

parks. Revenue in the Lake Parks fund increased $235,000 in FY18 from the previous year

The total citywide ending fund balance projected at FY19 year-end is $58.8 million, an increase of

$82,743. Increases in the balances of the Convention & Visitors, Stormwater Drainage, Utility

Enterprise and Lake Parks funds are projected to be offset by the drawdown of fund balances in the

Debt Service and Permanent Capital / Street Maintenance funds.

Total Fund Balance

All Budgeted Funds, as of September 30

$90,000,000

$75,000,000

$60,000,000

$45,000,000

$30,000,000

$15,000,000

$0

2014 2015 2016 2017 2018 2019

$53,544,837 $73,615,459 $81,711,195 $52,966,679 $58,749,637 $58,832,380

Note: The totals for years 2014 through 2017 are actual (audited); the total for 2018 is estimated;

and the total for year 2019 is projected.

26