Page 62 - Fort Worth City Budget 2019

P. 62

Budget Highlights

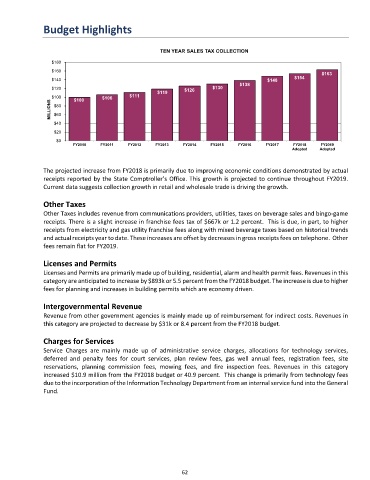

TEN YEAR SALES TAX COLLECTION

$180

$160

$163

$154

$140 $148

$138

$120 $126 $130

$119

$100 $100 $106 $111

MILLIONS $80

$60

$40

$20

$0

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019

Adopted Adopted

The projected increase from FY2018 is primarily due to improving economic conditions demonstrated by actual

receipts reported by the State Comptroller’s Office. This growth is projected to continue throughout FY2019.

Current data suggests collection growth in retail and wholesale trade is driving the growth.

Other Taxes

Other Taxes includes revenue from communications providers, utilities, taxes on beverage sales and bingo-game

receipts. There is a slight increase in franchise fees tax of $667k or 1.2 percent. This is due, in part, to higher

receipts from electricity and gas utility franchise fees along with mixed beverage taxes based on historical trends

and actual receipts year to date. These increases are offset by decreases in gross receipts fees on telephone. Other

fees remain flat for FY2019.

Licenses and Permits

Licenses and Permits are primarily made up of building, residential, alarm and health permit fees. Revenues in this

category are anticipated to increase by $893k or 5.5 percent from the FY2018 budget. The increase is due to higher

fees for planning and increases in building permits which are economy driven.

Intergovernmental Revenue

Revenue from other government agencies is mainly made up of reimbursement for indirect costs. Revenues in

this category are projected to decrease by $31k or 8.4 percent from the FY2018 budget.

Charges for Services

Service Charges are mainly made up of administrative service charges, allocations for technology services,

deferred and penalty fees for court services, plan review fees, gas well annual fees, registration fees, site

reservations, planning commission fees, mowing fees, and fire inspection fees. Revenues in this category

increased $10.9 million from the FY2018 budget or 40.9 percent. This change is primarily from technology fees

due to the incorporation of the Information Technology Department from an internal service fund into the General

Fund.

62