Page 3 - Fort Worth City Budget 2019

P. 3

Truth in Taxation

CITY OF FORT WORTH, TEXAS

FISCAL YEAR 2018-2019

ANNUAL BUDGET

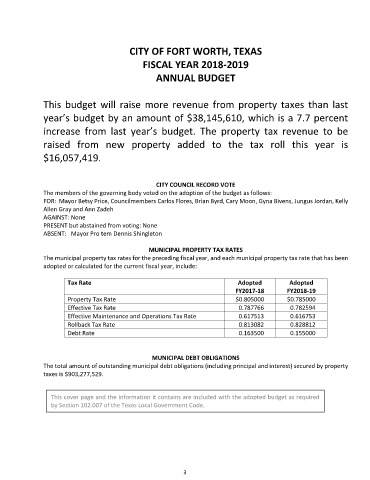

This budget will raise more revenue from property taxes than last

year’s budget by an amount of $38,145,610, which is a 7.7 percent

increase from last year’s budget. The property tax revenue to be

raised from new property added to the tax roll this year is

$16,057,419.

CITY COUNCIL RECORD VOTE

The members of the governing body voted on the adoption of the budget as follows:

FOR: Mayor Betsy Price, Councilmembers Carlos Flores, Brian Byrd, Cary Moon, Gyna Bivens, Jungus Jordan, Kelly

Allen Gray and Ann Zadeh

AGAINST: None

PRESENT but abstained from voting: None

ABSENT: Mayor Pro tem Dennis Shingleton

MUNICIPAL PROPERTY TAX RATES

The municipal property tax rates for the preceding fiscal year, and each municipal property tax rate that has been

adopted or calculated for the current fiscal year, include:

Tax Rate Adopted Adopted

FY2017-18 FY2018-19

Property Tax Rate $0.805000 $0.785000

Effective Tax Rate 0.787766 0.782594

Effective Maintenance and Operations Tax Rate 0.617513 0.616753

Rollback Tax Rate 0.813082 0.828812

Debt Rate 0.163500 0.155000

MUNICIPAL DEBT OBLIGATIONS

The total amount of outstanding municipal debt obligations (including principal and interest) secured by property

taxes is $903,277,529.

This cover page and the information it contains are included with the adopted budget as required

by Section 102.007 of the Texas Local Government Code.

3