Page 22 - Fort Worth City Budget 2019

P. 22

Executive Message

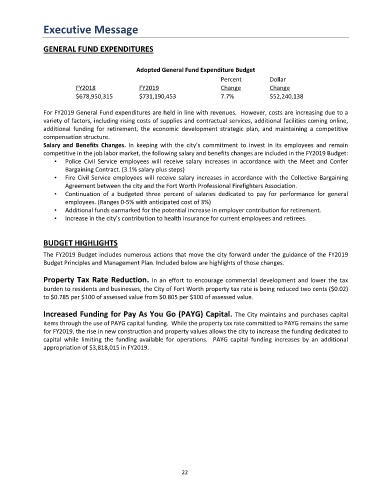

GENERAL FUND EXPENDITURES

Adopted General Fund Expenditure Budget

Percent Dollar

FY2018 FY2019 Change Change

$678,950,315 $731,190,453 7.7% $52,240,138

For FY2019 General Fund expenditures are held in line with revenues. However, costs are increasing due to a

variety of factors, including rising costs of supplies and contractual services, additional facilities coming online,

additional funding for retirement, the economic development strategic plan, and maintaining a competitive

compensation structure.

Salary and Benefits Changes. In keeping with the city’s commitment to invest in its employees and remain

competitive in the job labor market, the following salary and benefits changes are included in the FY2019 Budget:

• Police Civil Service employees will receive salary increases in accordance with the Meet and Confer

Bargaining Contract. (3.1% salary plus steps)

• Fire Civil Service employees will receive salary increases in accordance with the Collective Bargaining

Agreement between the city and the Fort Worth Professional Firefighters Association.

• Continuation of a budgeted three percent of salaries dedicated to pay for performance for general

employees. (Ranges 0-5% with anticipated cost of 3%)

• Additional funds earmarked for the potential increase in employer contribution for retirement.

• Increase in the city’s contribution to health insurance for current employees and retirees.

BUDGET HIGHLIGHTS

The FY2019 Budget includes numerous actions that move the city forward under the guidance of the FY2019

Budget Principles and Management Plan. Included below are highlights of those changes.

Property Tax Rate Reduction. In an effort to encourage commercial development and lower the tax

burden to residents and businesses, the City of Fort Worth property tax rate is being reduced two cents ($0.02)

to $0.785 per $100 of assessed value from $0.805 per $100 of assessed value.

Increased Funding for Pay As You Go (PAYG) Capital. The City maintains and purchases capital

items through the use of PAYG capital funding. While the property tax rate committed to PAYG remains the same

for FY2019, the rise in new construction and property values allows the city to increase the funding dedicated to

capital while limiting the funding available for operations. PAYG capital funding increases by an additional

appropriation of $3,818,015 in FY2019.

22