Page 132 - Fort Worth City Budget 2019

P. 132

General Fund

Non Departmental

DEPARTMENT SUMMARY

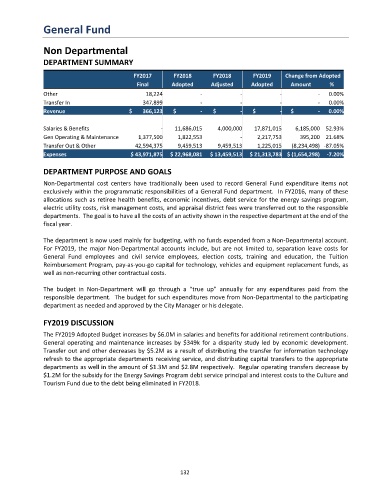

FY2017 FY2018 FY2018 FY2019 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Other 18,224 - - - - 0.00%

Transfer In 347,899 - - - - 0.00%

Revenue $ 366,123 $ - $ - $ - $ - 0.00%

Salaries & Benefits - 11,686,015 4,000,000 17,871,015 6,185,000 52.93%

Gen Operating & Maintenance 1,377,500 1,822,553 - 2,217,753 395,200 21.68%

Transfer Out & Other 42,594,375 9,459,513 9,459,513 1,225,015 (8,234,498) -87.05%

Expenses $ 43,971,875 $ 22,968,081 $ 13,459,513 $ 21,313,783 $ (1,654,298) -7.20%

DEPARTMENT PURPOSE AND GOALS

Non-Departmental cost centers have traditionally been used to record General Fund expenditure items not

exclusively within the programmatic responsibilities of a General Fund department. In FY2016, many of these

allocations such as retiree health benefits, economic incentives, debt service for the energy savings program,

electric utility costs, risk management costs, and appraisal district fees were transferred out to the responsible

departments. The goal is to have all the costs of an activity shown in the respective department at the end of the

fiscal year.

The department is now used mainly for budgeting, with no funds expended from a Non-Departmental account.

For FY2019, the major Non-Departmental accounts include, but are not limited to, separation leave costs for

General Fund employees and civil service employees, election costs, training and education, the Tuition

Reimbursement Program, pay-as-you-go capital for technology, vehicles and equipment replacement funds, as

well as non-recurring other contractual costs.

The budget in Non-Department will go through a “true up” annually for any expenditures paid from the

responsible department. The budget for such expenditures move from Non-Departmental to the participating

department as needed and approved by the City Manager or his delegate.

FY2019 DISCUSSION

The FY2019 Adopted Budget increases by $6.0M in salaries and benefits for additional retirement contributions.

General operating and maintenance increases by $349k for a disparity study led by economic development.

Transfer out and other decreases by $5.2M as a result of distributing the transfer for information technology

refresh to the appropriate departments receiving service, and distributing capital transfers to the appropriate

departments as well in the amount of $1.3M and $2.8M respectively. Regular operating transfers decrease by

$1.2M for the subsidy for the Energy Savings Program debt service principal and interest costs to the Culture and

Tourism Fund due to the debt being eliminated in FY2018.

132