Page 45 - Microsoft Word - Budget FY 19

P. 45

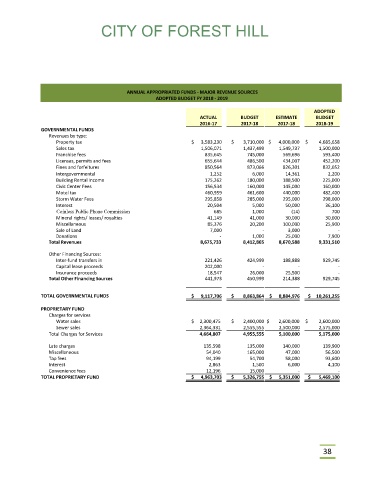

CITY OF FOREST HILL

ANNUAL APPROPRIATED FUNDS ‐ MAJOR REVENUE SOURCES

ADOPTED BUDGET FY 2018 ‐ 2019

ADOPTED

ACTUAL BUDGET ESTIMATE BUDGET

2016‐17 2017‐18 2017‐18 2018‐19

GOVERNMENTAL FUNDS

Revenues by type:

Property tax $ 3,583,230 $ 3,710,000 $ 4,000,000 $ 4,685,658

Sales tax 1,506,071 1,437,499 1,549,737 1,500,000

Franchise fees 835,645 745,000 569,696 593,400

Licenses, permits and fees 655,644 486,500 434,007 452,200

Fines and forfeitures 850,564 873,066 826,301 832,052

Intergovernmental 1,252 6,000 14,361 2,200

Building Rental Income 175,262 180,000 188,500 225,000

Civic Center Fees 156,534 160,000 145,000 160,000

Motel tax 460,959 461,600 440,000 482,400

Storm Water Fees 295,858 285,000 295,000 298,000

Interest 20,504 5,000 50,000 36,100

Coinless Public Phone Commission 685 1,000 (14) 700

Mineral rights/ leases/ royalties 41,149 41,000 30,000 30,000

Miscellaneous 85,376 20,200 100,000 25,900

Sale of Land 7,000 ‐ 3,000 ‐

Donations ‐ 1,000 25,000 7,900

Total Revenues 8,675,733 8,412,865 8,670,588 9,331,510

Other Financing Sources:

Inter‐fund transfers in 221,426 424,999 188,888 929,745

Capital lease proceeds 202,000 ‐ ‐ ‐

Insurance proceeds 18,547 26,000 25,500 ‐

Total Other Financing Sources 441,973 450,999 214,388 929,745

TOTAL GOVERNMENTAL FUNDS $ 9,117,706 $ 8,863,864 $ 8,884,976 $ 10,261,255

PROPRIETARY FUND

Charges for services

Water sales $ 2,300,475 $ 2,400,000 $ 2,600,000 $ 2,600,000

Sewer sales 2,364,331 2,555,555 2,500,000 2,575,000

Total Charges for Services 4,664,807 4,955,555 5,100,000 5,175,000

Late charges 135,598 135,000 140,000 139,900

Miscellaneous 54,040 165,000 47,000 56,500

Tap fees 94,199 54,700 58,000 93,600

Interest 2,863 1,500 6,000 4,100

Convenience fees 12,196 15,000 ‐ ‐

TOTAL PROPRIETARY FUND $ 4,963,703 $ 5,326,755 $ 5,351,000 $ 5,469,100

38