Page 117 - Microsoft Word - Budget FY 19

P. 117

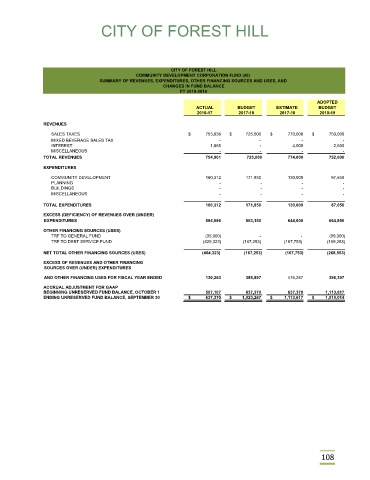

CITY OF FOREST HILL

CITY OF FOREST HILL

COMMUNITY DEVELOPMENT CORPORATION FUND (49)

SUMMARY OF REVENUES, EXPENDITURES, OTHER FINANCING SOURCES AND USES, AND

CHANGES IN FUND BALANCE

FY 2018-2019

ADOPTED

ACTUAL BUDGET ESTIMATE BUDGET

2016-17 2017-18 2017-18 2018-19

REVENUES

SALES TAXES $ 753,036 $ 725,000 $ 770,000 $ 750,000

MIXED BEVERAGE SALES TAX - - - -

INTEREST 1,865 - 4,000 2,600

MISCELLANEOUS - - - -

TOTAL REVENUES 754,901 725,000 774,000 752,600

EXPENDITURES

COMMUNITY DEVELOPMENT 160,312 171,850 130,000 87,650

PLANNING - - - -

BUILDINGS - - - -

MISCELLANEOUS - - - -

TOTAL EXPENDITURES 160,312 171,850 130,000 87,650

EXCESS (DEFICIENCY) OF REVENUES OVER (UNDER)

EXPENDITURES 594,586 553,150 644,000 664,950

OTHER FINANCING SOURCES (USES)

TRF TO GENERAL FUND (35,000) - - (99,300)

TRF TO DEBT SERVICE FUND (429,323) (167,253) (167,753) (169,253)

NET TOTAL OTHER FINANCING SOURCES (USES) (464,323) (167,253) (167,753) (268,553)

EXCESS OF REVENUES AND OTHER FINANCING

SOURCES OVER (UNDER) EXPENDITURES

AND OTHER FINANCING USES FOR FISCAL YEAR ENDED 130,263 385,897 476,247 396,397

ACCRUAL ADJUSTMENT FOR GAAP

BEGINNING UNRESERVED FUND BALANCE, OCTOBER 1 507,107 637,370 637,370 1,113,617

ENDING UNRESERVED FUND BALANCE, SEPTEMBER 30 $ 637,370 $ 1,023,267 $ 1,113,617 $ 1,510,014

108