Page 233 - Colleyville FY19 Budget

P. 233

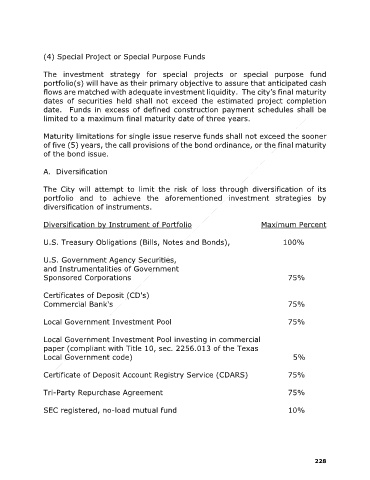

(4) Special Project or Special Purpose Funds

The investment strategy for special projects or special purpose fund

portfolio(s) will have as their primary objective to assure that anticipated cash

flows are matched with adequate investment liquidity. The city’s final maturity

dates of securities held shall not exceed the estimated project completion

date. Funds in excess of defined construction payment schedules shall be

limited to a maximum final maturity date of three years.

Maturity limitations for single issue reserve funds shall not exceed the sooner

of five (5) years, the call provisions of the bond ordinance, or the final maturity

of the bond issue.

A. Diversification

The City will attempt to limit the risk of loss through diversification of its

portfolio and to achieve the aforementioned investment strategies by

diversification of instruments.

Diversification by Instrument of Portfolio Maximum Percent

U.S. Treasury Obligations (Bills, Notes and Bonds), 100%

U.S. Government Agency Securities,

and Instrumentalities of Government

Sponsored Corporations 75%

Certificates of Deposit (CD's)

Commercial Bank's 75%

Local Government Investment Pool 75%

Local Government Investment Pool investing in commercial

paper (compliant with Title 10, sec. 2256.013 of the Texas

Local Government code) 5%

Certificate of Deposit Account Registry Service (CDARS) 75%

Tri-Party Repurchase Agreement 75%

SEC registered, no-load mutual fund 10%

228