Page 171 - Colleyville FY19 Budget

P. 171

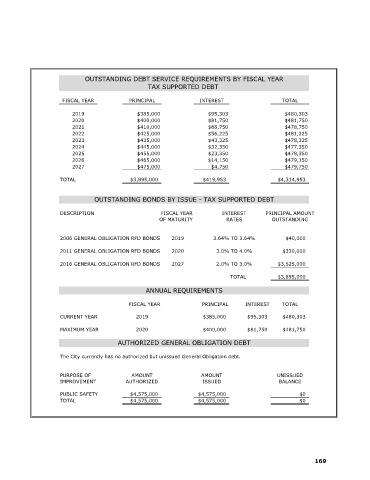

OUTSTANDING DEBT SERVICE REQUIREMENTS BY FISCAL YEAR

TAX SUPPORTED DEBT

FISCAL YEAR PRINCIPAL INTEREST TOTAL

2019 $385,000 $95,303 $480,303

2020 $400,000 $81,750 $481,750

2021 $410,000 $68,750 $478,750

2022 $425,000 $56,225 $481,225

2023 $435,000 $43,325 $478,325

2024 $445,000 $32,350 $477,350

2025 $455,000 $23,350 $478,350

2026 $465,000 $14,150 $479,150

2027 $475,000 $4,750 $479,750

TOTAL $3,895,000 $419,953 $4,314,953

OUTSTANDING BONDS BY ISSUE - TAX SUPPORTED DEBT

DESCRIPTION FISCAL YEAR INTEREST PRINCIPAL AMOUNT

OF MATURITY RATES OUTSTANDING

2006 GENERAL OBLIGATION RFD BONDS 2019 3.64% TO 3.64% $40,000

2011 GENERAL OBLIGATION RFD BONDS 2020 3.0% TO 4.0% $330,000

2016 GENERAL OBLIGATION RFD BONDS 2027 2.0% TO 3.0% $3,525,000

TOTAL $3,895,000

ANNUAL REQUIREMENTS

FISCAL YEAR PRINCIPAL INTEREST TOTAL

CURRENT YEAR 2019 $385,000 $95,303 $480,303

MAXIMUM YEAR 2020 $400,000 $81,750 $481,750

AUTHORIZED GENERAL OBLIGATION DEBT

The City currently has no authorized but unissued General Obligation debt.

PURPOSE OF AMOUNT AMOUNT UNISSUED

IMPROVEMENT AUTHORIZED ISSUED BALANCE

PUBLIC SAFETY $4,575,000 $4,575,000 $0

TOTAL $4,575,000 $4,575,000 $0

169