Page 64 - Azle City Budget 2019

P. 64

GENERAL FUND – IN BRIEF

REVENUES

The General Fund budget, as amended and approved by the City Council, provides for

estimated revenues of $10,135,020 during FY 2018-19. This reflects an increase of $848,536

(9.14%) in revenue over the FY 2017-18 budget. The majority of General Fund revenue is

comprised of the various taxes levied by the City, totaling 78.15% of all fund revenue. This

year’s General Fund ad valorem tax levy is projected to be $5,110,560, which is an increase of

$543,759 (11.91%) over last year’s budgeted levy and is derived from a net taxable value of

$887,916,146. Because the City of Azle lies in both Tarrant County and Parker County, the net

taxable value is determined by the Tarrant Appraisal District and the Parker County Appraisal

th

District. Each district provides a certified tax roll to the City on or around July 25 each year.

Taxable values increased $86,855,014 over the 2017 values and over a third of the increase

(37.51%) is attributable to new construction totaling $32,578,488. The City’s tax rate of

$0.667287 per $100 is $0.004213 less than the FY 2016-17 adopted tax rate. This year’s rate

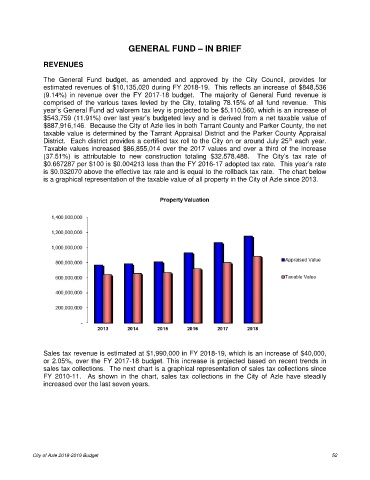

is $0.032070 above the effective tax rate and is equal to the rollback tax rate. The chart below

is a graphical representation of the taxable value of all property in the City of Azle since 2013.

Sales tax revenue is estimated at $1,990,000 in FY 2018-19, which is an increase of $40,000,

or 2.05%, over the FY 2017-18 budget. This increase is projected based on recent trends in

sales tax collections. The next chart is a graphical representation of sales tax collections since

FY 2010-11. As shown in the chart, sales tax collections in the City of Azle have steadily

increased over the last seven years.

City of Azle 2018-2019 Budget 52