Page 49 - Azle City Budget 2019

P. 49

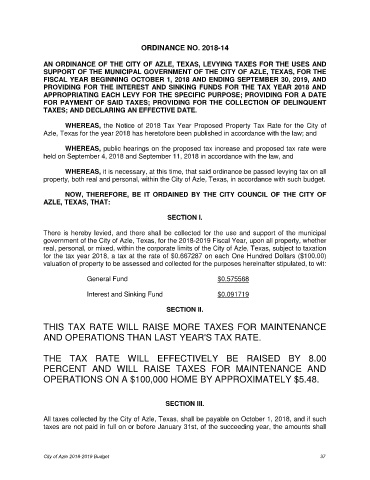

ORDINANCE NO. 2018-14

AN ORDINANCE OF THE CITY OF AZLE, TEXAS, LEVYING TAXES FOR THE USES AND

SUPPORT OF THE MUNICIPAL GOVERNMENT OF THE CITY OF AZLE, TEXAS, FOR THE

FISCAL YEAR BEGINNING OCTOBER 1, 2018 AND ENDING SEPTEMBER 30, 2019, AND

PROVIDING FOR THE INTEREST AND SINKING FUNDS FOR THE TAX YEAR 2018 AND

APPROPRIATING EACH LEVY FOR THE SPECIFIC PURPOSE; PROVIDING FOR A DATE

FOR PAYMENT OF SAID TAXES; PROVIDING FOR THE COLLECTION OF DELINQUENT

TAXES; AND DECLARING AN EFFECTIVE DATE.

WHEREAS, the Notice of 2018 Tax Year Proposed Property Tax Rate for the City of

Azle, Texas for the year 2018 has heretofore been published in accordance with the law; and

WHEREAS, public hearings on the proposed tax increase and proposed tax rate were

held on September 4, 2018 and September 11, 2018 in accordance with the law, and

WHEREAS, it is necessary, at this time, that said ordinance be passed levying tax on all

property, both real and personal, within the City of Azle, Texas, in accordance with such budget.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF

AZLE, TEXAS, THAT:

SECTION I.

There is hereby levied, and there shall be collected for the use and support of the municipal

government of the City of Azle, Texas, for the 2018-2019 Fiscal Year, upon all property, whether

real, personal, or mixed, within the corporate limits of the City of Azle, Texas, subject to taxation

for the tax year 2018, a tax at the rate of $0.667287 on each One Hundred Dollars ($100.00)

valuation of property to be assessed and collected for the purposes hereinafter stipulated, to wit:

General Fund $0.575568

Interest and Sinking Fund $0.091719

SECTION II.

THIS TAX RATE WILL RAISE MORE TAXES FOR MAINTENANCE

AND OPERATIONS THAN LAST YEAR'S TAX RATE.

THE TAX RATE WILL EFFECTIVELY BE RAISED BY 8.00

PERCENT AND WILL RAISE TAXES FOR MAINTENANCE AND

OPERATIONS ON A $100,000 HOME BY APPROXIMATELY $5.48.

SECTION III.

All taxes collected by the City of Azle, Texas, shall be payable on October 1, 2018, and if such

taxes are not paid in full on or before January 31st, of the succeeding year, the amounts shall

City of Azle 2018-2019 Budget 37