Page 15 - Azle City Budget 2019

P. 15

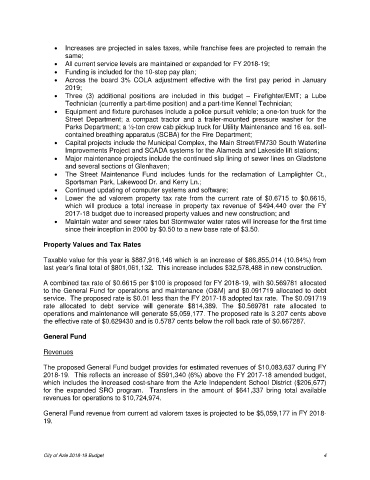

• Increases are projected in sales taxes, while franchise fees are projected to remain the

same;

• All current service levels are maintained or expanded for FY 2018-19;

• Funding is included for the 10-step pay plan;

• Across the board 3% COLA adjustment effective with the first pay period in January

2019;

• Three (3) additional positions are included in this budget – Firefighter/EMT; a Lube

Technician (currently a part-time position) and a part-time Kennel Technician;

• Equipment and fixture purchases include a police pursuit vehicle; a one-ton truck for the

Street Department; a compact tractor and a trailer-mounted pressure washer for the

Parks Department; a ½-ton crew cab pickup truck for Utility Maintenance and 16 ea. self-

contained breathing apparatus (SCBA) for the Fire Department;

• Capital projects include the Municipal Complex, the Main Street/FM730 South Waterline

Improvements Project and SCADA systems for the Alameda and Lakeside lift stations;

• Major maintenance projects include the continued slip lining of sewer lines on Gladstone

and several sections of Glenhaven;

• The Street Maintenance Fund includes funds for the reclamation of Lamplighter Ct.,

Sportsman Park, Lakewood Dr. and Kerry Ln.;

• Continued updating of computer systems and software;

• Lower the ad valorem property tax rate from the current rate of $0.6715 to $0.6615,

which will produce a total increase in property tax revenue of $494,440 over the FY

2017-18 budget due to increased property values and new construction; and

• Maintain water and sewer rates but Stormwater water rates will increase for the first time

since their inception in 2000 by $0.50 to a new base rate of $3.50.

Property Values and Tax Rates

Taxable value for this year is $887,916,146 which is an increase of $86,855,014 (10.84%) from

last year’s final total of $801,061,132. This increase includes $32,578,488 in new construction.

A combined tax rate of $0.6615 per $100 is proposed for FY 2018-19, with $0.569781 allocated

to the General Fund for operations and maintenance (O&M) and $0.091719 allocated to debt

service. The proposed rate is $0.01 less than the FY 2017-18 adopted tax rate. The $0.091719

rate allocated to debt service will generate $814,389. The $0.569781 rate allocated to

operations and maintenance will generate $5,059,177. The proposed rate is 3.207 cents above

the effective rate of $0.629430 and is 0.5787 cents below the roll back rate of $0.667287.

General Fund

Revenues

The proposed General Fund budget provides for estimated revenues of $10,083,637 during FY

2018-19. This reflects an increase of $591,340 (6%) above the FY 2017-18 amended budget,

which includes the increased cost-share from the Azle Independent School District ($206,677)

for the expanded SRO program. Transfers in the amount of $641,337 bring total available

revenues for operations to $10,724,974.

General Fund revenue from current ad valorem taxes is projected to be $5,059,177 in FY 2018-

19.

City of Azle 2018-19 Budget 4