Page 276 - City of Arlington FY19 Adopted Operating Budget

P. 276

Appendices

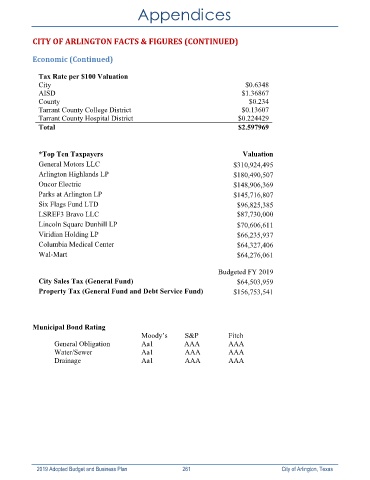

CITY OF ARLINGTON FACTS & FIGURES (CONTINUED)

Economic (Continued)

Tax Rate per $100 Valuation

City $0.6348

AISD $1.36867

County $0.234

Tarrant County College District $0.13607

Tarrant County Hospital District $0.224429

Total $2.597969

*Top Ten Taxpayers Valuation

General Motors LLC $310,924,495

Arlington Highlands LP $180,490,507

Oncor Electric $148,906,369

Parks at Arlington LP $145,716,807

Six Flags Fund LTD $96,825,385

LSREF3 Bravo LLC $87,730,000

Lincoln Square Dunhill LP $70,606,611

Viridian Holding LP $66,235,937

Columbia Medical Center $64,327,406

Wal-Mart $64,276,061

Budgeted FY 2019

City Sales Tax (General Fund) $64,503,959

Property Tax (General Fund and Debt Service Fund) $156,753,541

Municipal Bond Rating

M oody’s S&P Fitch

General Obligation Aa1 AAA AAA

Water/Sewer Aa1 AAA AAA

Drainage Aa1 AAA AAA

2019 Adopted Budget and Business Plan 261 City of Arlington, Texas